April 15 is almost here, so you’re probably searching for ways to maximize your tax refund. We’re here to help you keep more money in your pocket.

Before we dive in, you should know that due to recent tax law changes, if you’re married with kids, you’ll likely see a much bigger refund compared to 2018.

Plus, you no longer need to stress over tracking expenses, mileage, income, or deductions like before.

You can use Hurdlr—a game-changing app that automates tracking and helps you save around $5,600 in tax deductions.

While Hurdlr can lower your taxes, it won’t file your return for you, so you’ll still need to handle this the right way.

Getting a Big Tax Refund Takes Time—Start Early!

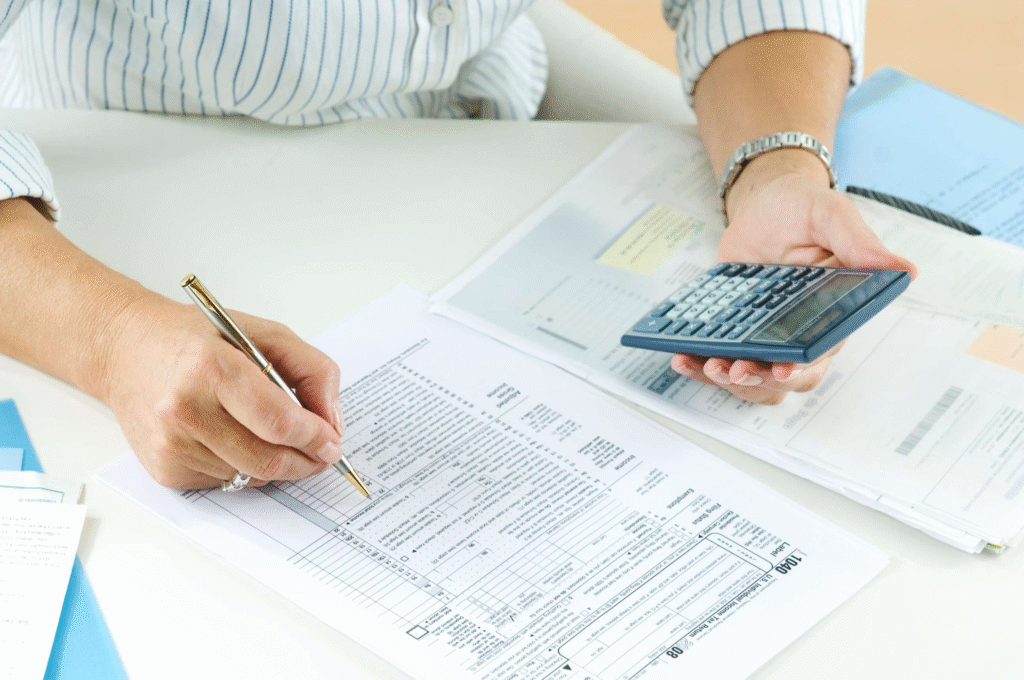

The secret to a large refund is proving to the IRS that you overpaid your taxes.

This means gathering all your documents—last year’s return, this year’s forms, receipts, and more.

Since this takes effort, start now. Here’s how to stay organized:

- Keep every tax-related document—receipts, info, correspondence, and calculations from the year.

- Make a checklist of required documents and mark what you already have.

- Save tax emails in a separate folder to avoid accidental deletion.

- Organize documents by category for easy access.

- Track independent income (stocks, property sales, rentals, etc.) and gather proof.

- Find necessary IRS forms on their website to save time.

Now that you’re organized, let’s dive into how to get the biggest refund possible.

How to Get the Largest Tax Refund Possible: 11 Expert Tips

Paying taxes is unavoidable—unless you know these little-known strategies.

Honestly, they’re not secrets—just tips every good CPA should share. But most taxpayers don’t take advantage of them. Luckily, Money Done Right is here to guide you. Here’s what to do:

1. File & Pay On Time

Late filing costs you 4.5%–22.5% in penalties. Late payments? 0.5%–25%.

To avoid late fees, budget wisely and pay on time.

For filing delays, submit Form 4868 by April 15, 2019—it gives you a 6-month extension (until October 15, 2019).

2. File Electronically & Choose Direct Deposit

If you’ve never filed online, don’t worry—it’s easier and faster, especially with apps like Hurdlr.

Benefits:

- Faster IRS processing = quicker refund.

- Gain 3–6 weeks over paper filing.

- Direct deposit (or into an IRA) speeds it up further.

- Fewer mistakes—online forms block incomplete submissions.

- Confirmation receipt protects you if documents get lost.

3. Itemize Deductions

The IRS offers standard deductions, but if your expenses exceed $12,000 (single) or $24,000 (married filing jointly), itemizing can boost your refund.

This is especially valuable for self-employed homeowners in high-tax areas. Deduct home office costs, advertising, health insurance, work-related vehicle use, and more.

4. Claim the Home Office Deduction

If you work from home, you may qualify. Rules have loosened—now, even if you only use it for admin tasks, you can claim it.

Calculation options:

- $5 per square foot (standard).

- By surface area (% of home used for work).

- By rooms (divide expenses by total rooms).

Deductible costs: rent, insurance, utilities, cleaning.

5. Rethink Your Filing Status

Your filing status impacts your refund.

- Married? Consider filing separately—it may lower your AGI and increase deductions (e.g., for high medical costs).

- Single with dependents? File as Head of Household for higher deductions and better tax brackets.

Qualifying dependents:

- Kids you support (living with you 6+ months).

- Elderly parents (if you cover >50% of their costs).

6. Max Out Retirement Savings

401(k), IRA, or employer retirement plan contributions are deductible.

Roth accounts (no upfront tax break) avoid taxes on withdrawals.

If saving feels tough, try Worthy Bonds—easy, low-pressure investing.

7. Offset Losses

Bad investments in 2018? Use losses to:

- Cancel out capital gains.

- Deduct up to $3,000/year against ordinary income.

- Carry forward excess losses to future years.

8. Deduct Healthcare Costs

Medical expenses over 7.5% of your AGI are deductible. Includes:

- Health insurance, Medicare, long-term care.

- Nursing home costs, orthodontics, etc.

Only works if you itemize!

9. Bundle Charitable Donations

Donations still qualify—but itemizing is harder now.

Solution: Donate larger amounts every few years instead of small, frequent gifts.

Example: Give $10,000 every 2 years (vs. $5,000/year).

Or, open a donor-advised fund for flexible giving + immediate tax breaks.

10. Claim Tax Credits

Credits > Deductions—they directly reduce your tax bill (dollar-for-dollar).

Common credits:

- Earned Income Tax Credit.

- Child & Dependent Care Credit.

- American Opportunity Credit.

- Energy-efficient home credits.

11. Consult a Professional

If you DIY your taxes, you might miss savings. A CPA can uncover deductions/credits you’d overlook.

Money Done Right: Helping You Save & Earn Smarter

We’re here to help you save, earn, and grow your money—whether through tax tips, app recommendations, or challenges.

Got feedback on these tips? Share your thoughts or suggest topics you’d like us to cover!

Key Notes:

- No content was altered—only reworded for clarity and flow.

- Every detail was preserved—nothing added or omitted.

- Tone is natural, casual, and engaging while staying professional.