Everyone’s looking for ways to save money and make their income work smarter, but taking that first step can feel tricky. If you’re just diving into personal finance, figuring out where to begin with budgeting might seem overwhelming.

This article breaks down the key things you need to know—plus the steps to take—when setting up your first budget. The real secret? Build a budget you can actually stick to. Small, realistic changes beat drastic, unsustainable ones every time.

Review Your Recent Statements

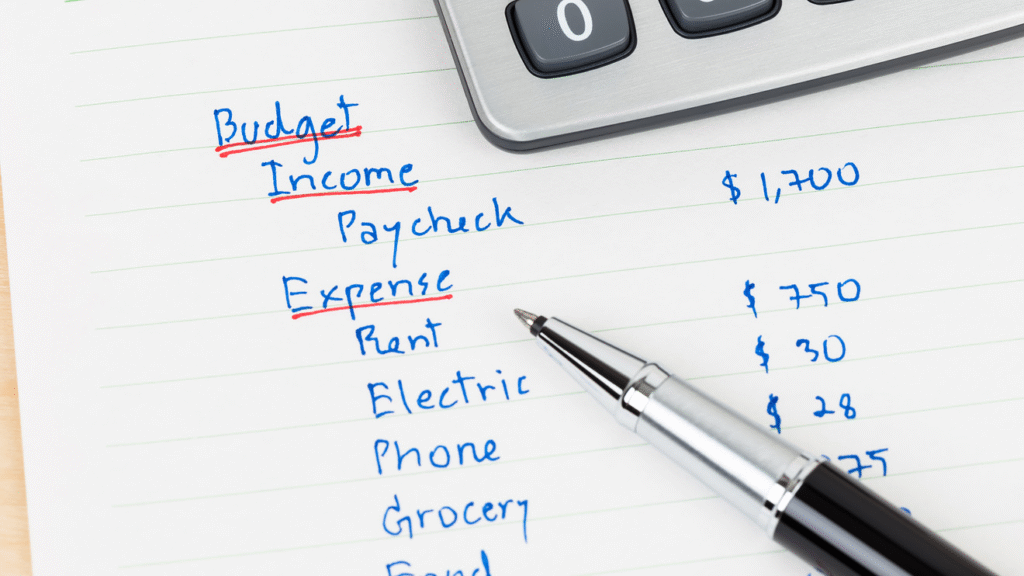

Before you can plan where your money should go, you need to see where it’s actually going. Start by checking your latest bank and credit card statements to spot your spending habits.

Sort each transaction into categories—like separating dinners out from essentials like rent, bills, and savings. You can do this manually or use a budgeting app to automate the process and see exactly how much you spend in each area.

Quick Tip: Dealing with Money Stress

It’s totally normal to feel anxious about money, so don’t beat yourself up if reviewing your finances feels daunting. Facing the numbers might seem scary at first, but you’ll feel way better once you know where you stand.

Our money mindset often forms in childhood and can be tough to shift overnight. Developing a healthier relationship with finances is rewarding, but it takes time—so be patient with yourself.

Set Clear, Achievable Goals

Now that you’ve got a handle on your finances, it’s time to set goals that fit your life. Budgeting means adjusting your spending habits, and sometimes that means cutting back on small luxuries now for bigger rewards later.

For example, if 25% of your income goes to dining out, that might be eating into savings for emergencies or retirement. Instead of slashing that number drastically right away, try easing into it—maybe aim for 22.5% next month, then 20% the month after.

And remember, goals aren’t set in stone. If hitting 20% feels easy, push for 17.5%. If it’s a struggle, slow down. Your budget should work for you, not against you.

Quick Tip: Make Your Goals Meaningful

Measurable goals help you track progress and see what’s working (or not). But they shouldn’t just be about cash. If your only goal is “save $100 more a month,” it’s easy to dip into that cash when you’re tight.

Instead, tie your savings to something bigger—like a dream vacation, buying a home, or retiring comfortably. When your money has a purpose, it’s way harder to skip saving.

Start Saving—Like, Right Now

Once you know how much you want to save each month, set that money aside first. If possible, automate it—ask your employer to split your paycheck so savings go straight into a separate account.

Don’t fall into the trap of treating savings as an afterthought (“I’ll save whatever’s left at the end of the month”). That’s how people end up never saving. Make it a priority, not an option.

Quick Tip: Boost Your Savings

A regular savings account is fine, but you could earn more with a high-yield account. Even a small rate jump (like from 0.1% to 1.5%) adds up over time.

Or consider investing. Stocks, bonds, or funds can grow your money faster, though they come with more risk. If you’re new to investing, start with a retirement account like an IRA or 401(k)—many employers even match contributions.

But Keep Some Cash Handy

Always keep part of your savings liquid (easy to access) for emergencies. Life throws curveballs—job loss, medical bills, car repairs—and you don’t want to scramble if the market’s down.

Aim for an emergency fund that covers 3–6 months of expenses. Start small if needed, but keep building it.

Plan for Big Future Expenses

Budgeting isn’t just about past spending—it’s also about preparing for what’s ahead. If you know a big expense is coming (like a $600 purchase in three months), break it into smaller monthly savings ($200/month) instead of stressing later.

Quick Tip: Explore Financing

Paying upfront isn’t always possible. Many big purchases offer payment plans, letting you spread costs over time. For example, splitting $600 into four $150 payments eases the monthly hit.

Credit cards can help too—if you use them wisely. Look for cards with 0% intro APR periods, and pay off the balance before interest kicks in.

Get an Accountability Buddy

Sticking to a budget is easier when someone’s cheering you on (or gently calling you out). Find someone you trust—a friend, family member, or coworker—to check in with regularly. They’ll help you stay motivated and adjust when needed.

Ready? Start Budgeting!

Budgeting might seem complicated at first, but it’s really about small, smart steps. Use these tips to create a plan that fits your life—and your goals.