How to Manage Money as a Couple: Rules You Need to Follow

Money conversations can be tough, especially when you’re in a relationship. Whether you’re just moving in together or have been married for years, managing money as a couple takes trust, transparency, and a lot of teamwork. It’s not just about balancing bills—it’s about aligning values, planning your future, and supporting each other through every financial decision. And the truth is, no two couples will handle their money exactly the same way.

The key isn’t to copy someone else’s strategy—it’s to find a system that works for both of you. From open communication to shared goals and individual autonomy, here’s how to approach money management in your relationship with clarity and confidence.

Talking about money means talking about how you were raised, what you believe about security, how you handle stress, and what your future looks like in real terms. It means figuring out how to build a life together while honoring each other’s differences. Maybe one of you loves to save and the other’s a bit more of a spender. Maybe one of you dreams of early retirement, while the other’s focused on traveling the world. These aren’t just preferences—they’re reflections of your values. Learning how to blend those values and make financial decisions as a team is what makes a relationship stronger.

:max_bytes(150000):strip_icc()/GettyImages-1214298174-633b3b8e47654b4196ec458802965850.jpg)

The truth is, there’s no single “right” way to manage money in a relationship. Some couples pool everything. Others prefer to keep things separate. Most land somewhere in between. What matters most is that the approach works for you, that you both feel heard and respected, and that the system supports your shared goals. Managing money as a couple is less about formulas and more about flexibility, communication, and commitment to building something that works—together.

Have the Money Talk Early and Often

One of the most important habits you can develop as a couple is simply talking about money—regularly. This isn’t a one-time chat where you reveal your salary and move on. It’s an ongoing conversation that evolves as your lives and goals change.

Start with the basics: income, savings, debt, financial goals, and spending habits. Be open and honest, even if it’s uncomfortable. Maybe one of you has student loans, credit card debt, or a habit of online shopping when stressed. Maybe the other is super frugal or prioritizes early retirement. These differences don’t have to be deal-breakers—but you do need to understand where each other is coming from.

Money talks should happen regularly, not just during crises. Schedule monthly or bi-weekly “money dates” to check in on your progress, budget, bills, and financial goals. When money becomes part of your normal conversations, it loses its power to create tension.

Be Honest About Your Financial Past and Present

Financial intimacy means being just as transparent with money as you are with your emotions. That includes your financial history—credit score, debts, bankruptcies, past financial mistakes—as well as your current money situation.

Secrets and surprises are financial landmines. If one of you has been hiding debt, spending beyond your means, or not contributing to shared expenses, that breach of trust can damage more than your finances—it can affect your emotional bond too.

Creating a safe space for honesty is essential. No judgment, no shame. Just real, raw facts. When both partners know the full picture, it’s easier to move forward as a team.

Decide Whether to Combine, Separate, or Blend Finances

There’s no universal “right” way to manage money as a couple. Some couples combine everything, others keep everything separate, and many do a hybrid of both. What matters is choosing a system that reflects your values and makes both partners feel respected and supported.

Combining finances can simplify budgeting and create a sense of unity. But it only works when both people have similar financial habits and full trust. Keeping finances separate can work well for couples with very different spending styles or those who value independence.

A blended approach—where you maintain individual accounts for personal expenses but contribute to a joint account for shared costs—is often the most balanced option. It allows you to preserve autonomy while still building a life together.

No matter which method you choose, make sure the expectations are clear and mutually agreed upon. Resentment often comes from one person feeling like they’re carrying more than their fair share.

Set Joint Financial Goals Together

A healthy financial relationship means dreaming together. Whether it’s saving for a home, starting a family, traveling the world, or paying off debt, your goals should reflect both partners’ dreams and timelines.

Sit down and ask each other: What are our top financial priorities right now? What do we want in the next year? The next five? Retirement? This isn’t just about logistics—it’s about vision. Where do you both see your lives going, and how can money help you get there?

Once you’ve identified your goals, break them down into action steps. How much will you save each month? Where will that money go? Who’s responsible for what? When you’re aligned in your vision, your financial decisions become easier—and much more rewarding.

Create a Budget You Both Can Live With

A shared life requires a shared spending plan. Your budget should reflect your income, your lifestyle, your values, and your goals. But here’s the key: it has to work for both of you.

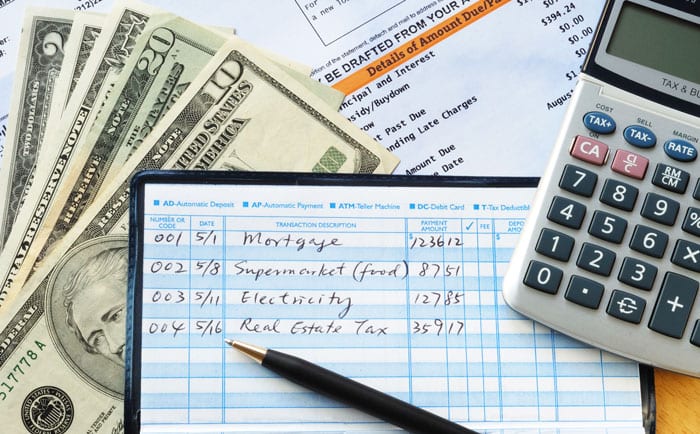

Start by listing all fixed expenses—rent, utilities, groceries, debt payments—and then factor in variable spending like dining out, entertainment, and shopping. Be realistic. One of you may be a natural saver, the other a natural spender, so your budget needs to strike a balance between discipline and flexibility.

Don’t forget to allocate money for fun. A budget that includes guilt-free personal spending for both partners is more likely to stick. You’re not roommates—you’re building a life together, and that means making room for joy as well as responsibility.

Use a shared budgeting app or spreadsheet to keep track of everything in one place. Whether it’s Splitwise, YNAB, or a good old-fashioned Google Sheet, find a system that works for your lifestyle.

Decide Who’s Managing What

In any relationship, financial tasks need to be divided fairly—even if you have joint accounts. That might mean one person handles the bills while the other tracks spending. Or one partner may manage investments while the other keeps tabs on subscriptions and day-to-day expenses.

The point isn’t to split things exactly 50/50—it’s to make sure no one feels overwhelmed or left in the dark. Know each other’s strengths. If one of you loves spreadsheets, they might take the lead on budgeting. If the other is detail-oriented, they might stay on top of due dates and bank accounts.

Make sure both of you have access to all accounts, logins, and documents. Transparency and teamwork go hand in hand.

Respect Each Other’s Financial Personalities

Just like love languages, everyone has a different money personality. One of you might be a risk-taker, always looking for the next investment opportunity. The other might be a security-seeker who prefers saving over spending.

Neither approach is “better”—they’re just different. Learning to respect, understand, and balance your financial personalities can prevent conflict and lead to smarter decisions.

Talk openly about how you each view money. Where did your beliefs come from? Childhood? Past relationships? Culture? Acknowledging these differences helps you build empathy—and compromise more effectively.

Maintain a Degree of Financial Independence

Even in the healthiest relationships, a little financial autonomy is essential. You don’t need to report every $5 coffee, and you shouldn’t feel guilty for buying something just for yourself.

Maintaining individual accounts for personal spending can help preserve a sense of independence, especially in long-term relationships. It also prevents arguments over small purchases and gives both partners space to manage money in their own way.

This isn’t about secrecy—it’s about mutual respect. Think of it like breathing room in your financial relationship. You’re a team, but you’re still two individuals with your own tastes, habits, and needs.

Prepare for the Unexpected

Life is unpredictable—and your finances need to be ready for that. As a couple, part of your job is to protect each other financially. That means building an emergency fund, buying insurance, preparing wills, and having plans for the “what ifs.”

What happens if one of you loses your job? Gets sick? Wants to go back to school? These are hard questions, but answering them now can spare you both a lot of stress later.

Make sure you both understand where important financial documents are stored. Create a shared folder with account info, insurance policies, legal documents, and contact lists. These aren’t fun conversations, but they’re necessary—and they show a deep level of care and responsibility.

Check in and Reassess Regularly

Your financial life isn’t static—neither is your relationship. Careers shift. Goals evolve. Families grow. And when life changes, your money plan should change too.

Set time aside every few months to reassess your budget, goals, and systems. Are you both still happy with the way things are split? Has your income changed? Are your priorities shifting?

Don’t wait until there’s a problem to have these conversations. Think of them as regular tune-ups for your relationship and your finances. When you treat money management as a team effort, it becomes less of a chore—and more of a shared path to your dream life.

FAQs: Managing Money as a Couple

Should couples combine all of their finances?

Not necessarily. Some couples thrive with joint accounts, while others prefer to keep things separate. Many find success with a hybrid system—joint accounts for shared expenses and individual accounts for personal spending. The best approach is one that respects both partners’ values and communication styles.

What if one person earns significantly more than the other?

That’s common, and it doesn’t have to create tension. Consider proportional contributions to shared expenses based on income. For example, the higher earner might cover 70% while the other contributes 30%. The goal is fairness—not forced equality.

How do we avoid fights about money?

Regular communication is key. Have open, judgment-free conversations about spending, goals, and challenges. Budget for personal spending so neither partner feels restricted, and revisit your plan often to make adjustments before issues arise.

What happens if one partner is in debt?

Be honest and transparent. If the debt was from before the relationship, decide together how it will be handled. Some couples pay it off together, while others keep it separate. The important thing is that both partners understand the plan and support each other through it.

Is financial counseling or coaching helpful for couples?

Absolutely. A neutral third party can help you navigate tough conversations, build a joint plan, and overcome sticking points. Think of it as financial therapy—an investment in your future peace and partnership.

Final Thoughts: Building Wealth and Trust Together

Managing money as a couple isn’t just about spreadsheets and bank accounts—it’s about trust, communication, and shared values. When you approach money as a team, you create more than a budget—you create a foundation for your life together.

You don’t have to get everything perfect. You just have to stay honest, stay flexible, and stay in sync. With the right mindset and habits, money can become one of the strongest parts of your relationship—not a source of stress.

Build a plan, dream big, check in often—and grow together.